Coinbase in 2025: Diversification through acquisition

Dec 24, 2025

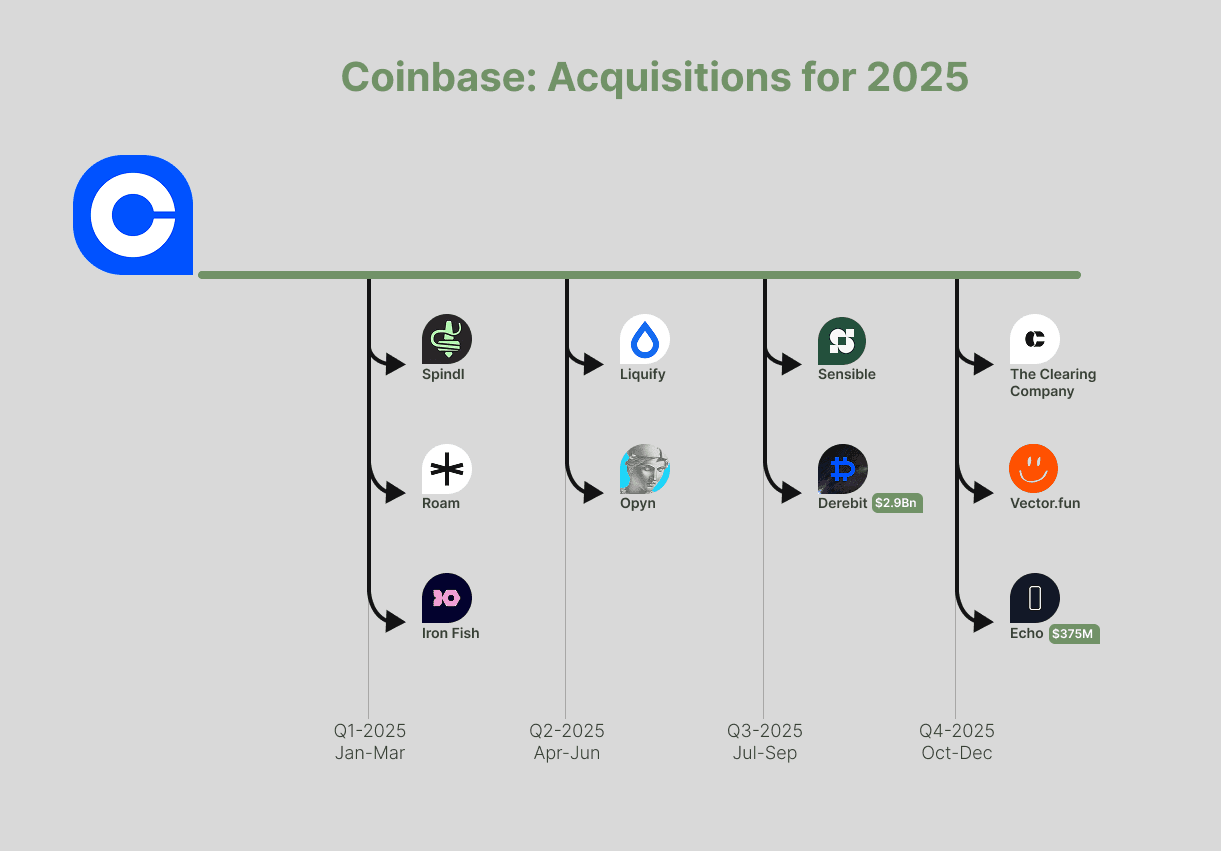

2025 was a year filled with high profile M&A deals. With big names like Ripple, Kraken throwing billions at acquiring companies and to solidify their position or gain headstart in new avenues, Coinbase remained at the forefront with around 10 acquisitions in the calendar year.

Throughout this endeavor, some accomplishments added up for Coinbase. This includes the largest acquisition of the year of Derebit, valued at $2.9 Bn. Coinbase also has one of the most acquisitions of the year with 10 and counting and overall around 30 acquisitions till date.

In this article, we take a deeper dive into Coinbase' acquisitions this year and what they mean for the company and industry in general.

Q1 2025 - January to March

Spindl

Coinbase acquisition of Spindl brings the onchain advertising and attribution platform directly under the umbrella of the Base ecosystem. Spindl's technology will now help developers and projects on Base L2 in measuring their campaign performance, user behavior and drive targeted growth without relying on opaque Web2 ad rails. Official Announcement

The move strengthens Coinbase position as the growth infrastructure layer in Web3.

Acquisition: The exact financial terms or valuation of the deal are not public. It is worth noting that Spindl raised $7M in Series A in 2022.

Roam

Rom is an onchain browser that has native web3 capabilities like minting and opening decentralized apps. The Roam team announced via their socials of joining Coinbase and continuing their journey with the Coinbase Banner. The acquisition adds another weapon in Base L2 Dapp arsenal.

Acquisition: Financial terms not known, there was no official announcement by the Coinbase team on the acquisition. Roam's valuation is also unknown.

Iron Fish

Base acquired the services of Iron Fish, a privacy focussed proof of work blockchain. It should be noted that Iron Fish has its own token and blockchain, but Coinbase specifically brought the team on board to enhance the Base L2's privacy capabilities.

Acquisition : Acquisition deal or valuation is not public, though its worth noting that Iron Fish raised a Series A at $27M with a16z as the lead investor.

Q2 2025 - April to June

Liquifi

Late June, Coinbase acquired Liquifi, a Sanfrancisco based startup that automates token vesting, distribution, and compliance for crypto startups. Liquifi tech stack and products will help ease up Token launching process, which often times face regulatory and financial hurdles. Official Announcement

Acquisition: Terms undisclosed, the company raised $5M in 2022 from Dragonfly and cohort.

Opyn

Opyn is a decentralized options trading protocol. Coinbase has been solidifying its path to dominance in the derivatives industry with a string of acquisitions in the derivatives space including Derebit. Point to note is that this is more of an 'acqui-hire' where the Opyn team is hired by coinbase. Official announcement

Acquisition: Deal terms not public, Opyn has raised aroudn $10M in past two rounds.

Q3 2025 - July to Spetember

Sensible

Coinbase acquired the founding team of Sensible, bringing their DeFi consumer app expertise in-house to speed up its on-chain consumer roadmap. The team will lead key product efforts that simplify access to decentralized finance, helping Coinbase evolve beyond trading into a full financial platform where users can borrow, stake, earn rewards and manage assets on-chain more easily.

Acquisition: Aqui-hire, hiring the team behind the project. Deal and valuation not public

Derebit

Coinbase completed its acquisition of Deribit, the leading crypto derivatives and options exchange, integrating its deep liquidity, high trading volumes and institutional user base to significantly expand Coinbase’s global derivatives offering. The deal advances Coinbase toward becoming a full-spectrum trading platform with spot, futures, perpetuals and options all under one roof, strengthening its competitive position in global crypto markets. Official Announcement

Acquisition: The largest acquisition of 2025, valued at $2.9Bn

Q4 2025 - October to December

The Clearing Company

Coinbase is acquiring The Clearing Company, a prediction-markets startup, to accelerate its entry into event-based trading. The deal brings deep prediction-market expertise into Coinbase’s platform, helping scale regulated contracts tied to real-world outcomes. This move reinforces its “Everything Exchange” vision by integrating prediction markets alongside crypto, equities, and derivatives.

Acquisition: Deal terms not public. No official announcement from Coinbase

Vector.fun

Vector is a Solana-focused crypto trading platform, which will deepen Coinbase support for Solana ecosystem liquidity and institutional access. The acquisition brings Vector’s order books and market-making infrastructure into Coinbase, enhancing execution quality for Solana assets. This strengthens Coinbase’s multi-chain trading capabilities and reinforces its commitment to expanding decentralized liquidity across leading layer-1 networks. Official announcement

Echo

Coinbase acquired Echo, a leading on-chain capital formation and fundraising platform, in a ~$375 M cash-and-stock deal to expand its role in crypto capital markets. Echo’s tools, including Sonar for public token sales and community-aligned fundraising, will be integrated into Coinbase’s ecosystem, enabling founders to raise capital on-chain while giving broader investor access to early-stage opportunities.

Acquisition: $375M